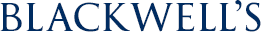

Publisher's Synopsis

The Adaptive Markets Hypothesis (AMH) presents a formal and systematic exposition of a new narrative about financial markets that reconciles rational investor behaviour with periods of temporary financial insanity. In this narrative, intelligent but fallible investors learn from and adapt to randomly shifting environments. Financial markets may not always be efficient, but they are highly competitive, innovative, and adaptive, varying in their degree of efficiency as investor populations and the financial landscape change over time. Andrew Lo and Ruixun Zhang develop the mathematical foundations of the AMH--a simple yet surprisingly powerful set of evolutionary models of behaviour--and then apply these foundations to show how the most fundamental economic behaviours that we take for granted can arise solely through natural selection. Drawing on recent advances in cognitive neuroscience and artificial intelligence, the book also explores how our brain affects economic and financial decision making. The AMH can be applied in many contexts, ranging from designing trading strategies, to managing risk and understanding financial crises, to formulating macroprudential policies to promote financial stability. This volume is a must read for anyone who has ever been puzzled and concerned by the behaviour of financial markets and the implications for their personal wealth, and seeks to learn how best to respond to such behaviour.